Today I want to continue from my previous post about how to save money each month. In particular I want to highlight some advices that can considerably make your life easier.

In the last post I explained the importance of tracking the expenses in order know where the money goes and quickly act to limit particular expenses in order to save money.

This post is dedicated to forecast your economic situation in the future.

This is another important aspect that all of us shall always take in mind. Usually we are afraid to buy one thing simply because we can not perceive the consequence to our personal balance. The questions we make every time is:

- What are the consequences if I buy this thing today?

And one of the most big errors that we make is summarized in this sentence:

- Ok today I can't buy this but when I receive the salary I'll certainly buy it!

For a lot of people this way of thinking gets troubles for the future. I'm obviously referring to the people that hasn't a big salary and must have attention to the monthly expenses: if you are rich enough you can continue reading the post because is useful also for investing money!

So the key of prevent negative personal balance is to estimate the amount of money for all the future days. In order to do this it's important to make a forecast planning about expenses after the existing balance report.

How to begin?

In the following paragraph I'll provide to you some important steps. In order to help how to organize the work I'll introduce one example made by me with the tool that I personally use for my balance: AceMoney. I really like this personal balance software as already said in the previous post but for this

work we need to use the section Schedule: all the following tips shall be inserted as a "regular expiring expense". Once we've done the work we can see the effect of the standard expenses over a long period (till 5years if I remember well):  |

| Fig.1: Forecast of personal balance based on current expenses. |

Standard fixed incomes

Go to the section Schedule and begin with incomes that are known every month:

- Salary

- Additional constant incomes like investment, interest etc.

In my example I’ve this situation:

| Fig.2: Fixed incomes are registered and scheduled. |

Standard fixed expenses

At this point we have to insert the only fixed standard outcomes such as:

- Monthly mortgage/rent of the house, car, motorbike etc.

- Monthly/bimestrial fixed bills like insurance, internet, pay-tv etc.

- Monthly fixed donations or money support for relatives for example

|

| Fig.3: Fixed expenses are registered and scheduled. |

Average of other fixed expenses

Here is the most complex aspect of this work.

Before inserting regular expenses it necessary to study these expenses over a long period (one year at least). AceMoney report page is the best for this scope. The steps to follow are always the same for every regular expense and they are:

- Select one (or more) year as analysis period

- Look at the column Mean/Median before the last one that is the total of the period.

- Find what are the common expenses that are present in all the months

- Mark and add them as monthly expenses with the average value that you found in the corresponding column

In order to show the previous points I report the result that I've obtained with a demo example:

|

| Fig.4: Monthly report. |

As you can see in my example there’re some constant expenses like Food, Cinema etc. that are present every months. So these will be converted as standard expense schedule with the Average value of the above table.

Now back to your balance report and see what happens to the field availability over the future.

Basically we can have 4 kind of situation:

- Frank: expenses are less then incomes EVERY months (the total will increase over the time)

- Dweezil: expenses are quite the same than the incomes (the total will grow very few over the months)

- Steve: expenses are more then incomes EVERY months (you're in a big trouble!)

- Strelok: periodic oscillations of negative and positive months (you have not the possibility to safely buy something)

Excluding the case 3 for obvious reason, the cases 2 and 4 are very important because do not represent a stable balance to afford a new considerable buy. Let's analyze them with our example.

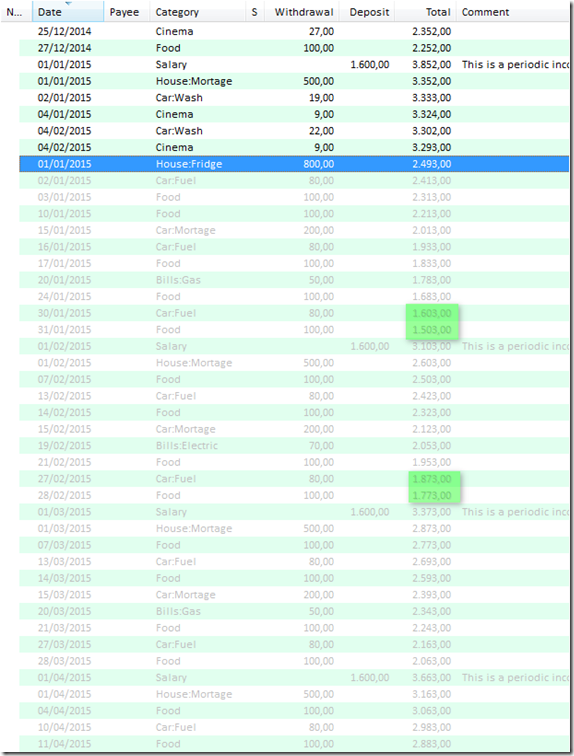

Simulation of buying a single not expensive thing

Now we want to answer to the question:”I want to buy a new fridge that costs 800$, can I afford it?”

Dweezil case:

The effect of buying this will only lower the total amount of available money. As he has 3293$ he can afford it, in fact look at the green areas where I highlighted the real effect of the buy.

|

| Fig.5: Dweezil lucky case. |

Strelok case:

The effect of buying this will lower the negative months, so the bank will get more interests about passive and so the total amount of available money can be compromised. As he's 2293$ today he thinks that he can afford it although the expense is “important”. Let’s see the estimation of Strelok balance at the end of the month:

|

| Fig.6: Strelok risky case. |

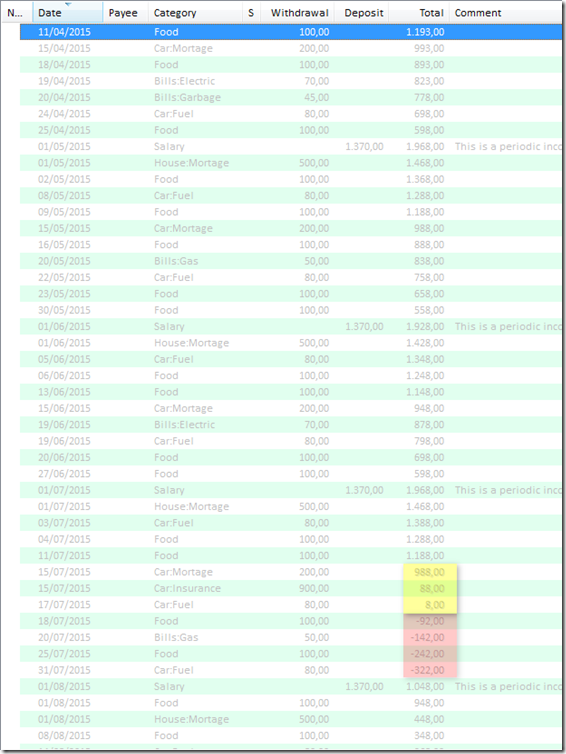

So it apparently seems that he can survive with only risky 500$ but with positive balance. So, this represent the typical case of a man that is doing a big error. Let’s see a more ahead period of estimation:

| Fig.7: Strelok risky case (begin of red balance). |

It seems that on the middle of July the effect of the expense plus the annual car insurance lower the balance below 0$: this implies debit!

Unfortunately AceMoney can not calculate the interest of the debit dynamically in the Account sheet so the red highlighted passives does not include additional negative due to the time that Strelok has the debit with his bank.

Let see again over a longer period:

|

| Fig.7: Strelok risky case (periodic red balance). |

So Strelok example is the typical error that people does when think to have money but does not take into account all the standard expenses over the year!

Some details:

- I'm assuming that the life of these persons are stable in term of changes: if you quickly change your life for new job, living locations, etc. the the reliability of the forecast period will be shorter but I think that you can still have a good estimation.

- I'm assuming that you track almost of the expenses and you exactly know where you spend your money.

- I'm assuming that you are using a money balance software that makes the same thing that I've shown above: my advice is to use AceMoney.

“When I'll have money for buying this?”

In this section title I've summarized one of the most common sentences that we think when we are sad due to the fact that we can't afford the object that we want to buy: it's simple! Look at the forecast report and find when the total amount of money will safely overcome the cost of what we want to buy: it's a good approach because very often the more time pass the more cheaper will become it (unless you're buying a collection object!).

Taking the risky Strelok example, we’ve demonstrated that he can’t afford the fridge now. Let’s try to find a good period of buying it with the addiction that he received a work promotion that rises the monthly salary to 1440$.

Considerations

The objective of this post is to communicate to you that, before doing wrong expenses, you should have a budget plan that takes in consideration all the inputs/outputs of your money deposit. My advices are not as an assurance for you life of course but helps to have less doubts before buying a thing.

If you have doubts or suggestions please feel free to comment!

See ya!

I liked your post. I'll try to use Acemoney also for my future expenses. Thanks a lot!

ReplyDeleteThanks.

ReplyDeleteExcellent guide. Thanks

ReplyDelete